Well folks, it’s finally here! Apple’s new payment system, Apple Pay, was released yesterday. I have mentioned this new payment system in two blogs both last month and last week, when I covered Apple’s two large events. If you’ve read those past two posts, you probably know how excited I am for Apple Pay.

If you don’t yet know my eagerness, here’s an excerpt from my blog on the iPhone 6 Event that sums it up pretty well:

…I will first have to admit my love for shopping, but there is one part I strongly dislike: checkout. When I head to checkout, I have to rummage through my purse, to get my wallet, to get my card out… It’s personally a challenge for me and my clumsy fingers. There have been a few instances where all the contents of my wallet end up on the floor; not only is that embarrassing, it’s also a major security problem. And if I do successfully obtain the plastic card, I have to reach up and attempt to swipe it then enter a PIN number on a keypad I can’t even see?!

Moving on, I do always have my iPhone handy. For years now, I have dreamt of how to make the payment process easier: “What if I could just save my card in my phone securely?” With Apple Pay that is now an option! The wasted moments of fumbling for my card may soon be a thing of the past…

As of yesterday, if you have an iPhone 6 or iPhone 6 Plus you can officially start buying things with the touch of a finger and by waving your phone over an enabled Point of Sale (POS) system. Though my enthusiasm of Apple Pay is obvious and unwavering, I found my knowledge of Apple Pay to be too limited. So I did more research and below are my findings.

4 Facts on Apple Pay:

1. Apple Pay has been labeled as a “digital wallet,” but it is much more complicated, comprised of multiple parts:

- Digital credit cards

- Secure element to store device-specific card numbers

- NFC radio

- Touch ID

Apple Pay lives inside Passbook, which according to Mashable “was originally designed to hold digital airplane tickets, coupons, gift cards and movie tickets; you can also use Apple Pay to add dollar amounts to, say, your Starbucks Rewards card.”

2. Apple Pay was launched with support of three major credit card companies:

- Visa

- MasterCard

- American Express

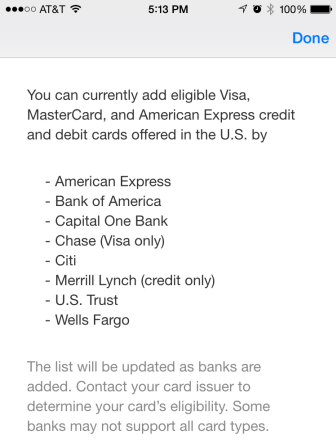

The bad news is that credit card companies are only part of the equation. Whoever issues your card (usually your bank) also has to support Apple Pay. Apple says they have the “top banks” and added 500 since announcing the payment system in September.

If you try to add a credit and debit card from a separate bank, you’ll be shown the following:

3. Adding credit cards to Apple Pay is pretty simple:

Adding credit cards to Apple Pay can be as simple as taking a photo with your phone’s camera.

- Take a picture of your credit card

- Apple Pay will automatically read and enter the name and number off the card

- You have to enter the security code and expiration date (only once)

- Now you’re ready to shop with Apple Pay!

You can decide which card you want to use as your default credit card, but you can store multiple credit cards in Apple Pay.

4. Apple Pay may be the end of credit card numbers:

Throughout the past year, there have been millions of customer records, including credit card numbers, stolen from Target and other major retailers in a data breach. Apple Pay increases your security by eliminating credit card numbers sitting in a merchant’s database. To do this, a device-specific number is tied to your actual credit card number as well as to your device. In other words:

“…the credit card number scanned by Apple Pay is not used to complete transactions. Instead, the credit card issuer generates a different, device-specific number that is stored in the iPhone’s hardware (the secure element). The credit card issuer receives that number for transactions and connects it to the card number on file for your account.

That means even if someone hacked Target’s system again and collected all these numbers, they would be of little use, since the numbers are tied to specific iPhones an iPads.” (Source: Mashable)

Final quick facts on Apple Pay:

- Your iPhone can be asleep when the transaction starts. It’ll wake up when it’s close to the POS.

- You do not have to select Apple Pay or open Passbook to rummage through your digital credit cards. Being near the POS automatically starts the transaction process.

- You do not have to touch your phone to the POS. Holding it an inch or so away is enough to start the transaction.

- You can select an alternate payment card from Apple Pay if you don’t touch the Touch ID pad.

- Completing a transaction only takes touching the Touch ID with one of your registered fingers.

- There is no concern about people accidentally activating purchases if they happen to be too close to the NFC reader; no transaction will take place until you touch the Touch ID.

- In other words, if you’re at the register, have your phone out and put your registered finger on Touch ID while the phone is hovering over the POS, it’s likely you meant to buy something.